Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on irs forms?

IRS forms will require information regarding your income, taxes withheld, deductions, credits, and any other relevant information. The type of information required will depend on the specific form.

IRS forms are documents that taxpayers in the United States are required to file with the Internal Revenue Service (IRS) to report income, claim deductions and credits, and calculate their tax obligations. These forms vary depending on an individual's or organization's specific tax situation. Some commonly used IRS forms include Form 1040 (individual tax return), Form 1099 (reporting certain types of income), and Form W-2 (reporting wages and salary information). These forms are used to ensure that taxpayers accurately report their income and pay the correct amount of taxes owed according to the tax laws and regulations in the United States.

Who is required to file irs forms?

The specific individuals or entities required to file IRS forms depend on various factors, such as their income, filing status, and type of income. Generally, individuals who earn a certain amount of income, whether from wages, self-employment, or other sources, are required to file federal tax returns and corresponding IRS forms. Likewise, entities such as corporations, partnerships, and trusts are typically required to file IRS forms specific to their type of entity. However, the specific requirements for filing IRS forms can change from year to year, so it is best to consult the IRS website or a tax professional for the most up-to-date information.

How to fill out irs forms?

Filling out IRS forms can seem complicated, but by following these general steps, you can navigate the process effectively:

1. Gather necessary documents: Collect all relevant documents, including W-2s, 1099s, receipts, and any other forms required for your specific situation.

2. Choose the correct form: Determine which IRS form is applicable to your situation. Common examples include Form 1040 (for individual tax returns) or Form 1099 (for reporting miscellaneous income).

3. Enter personal information: Start by filling in your personal details such as your name, social security number, and address. Double-check this information for accuracy.

4. Report income: Follow the instructions on your chosen form to report all sources of income accurately. Ensure that all income sources, including wages, self-employment earnings, and investment income, are properly reported.

5. Deductions and credits: Determine which deductions and credits you qualify for and appropriately enter them on the form. Common examples include the standard deduction, itemized deductions, and tax credits for dependents or education expenses.

6. Calculate your tax liability: Use the provided instructions or an IRS tax calculator to determine your tax liability. Ensure that all calculations are done accurately and that you are using the correct tax tables or specific calculations for your situation.

7. Complete payment information: If you owe taxes, include your payment information, such as a check or your bank account details, to facilitate payment.

8. Double-check and sign: Review the completed form for any errors or omissions. Ensure all the necessary schedules and supporting documents are attached, if applicable. Finally, sign and date the form to certify your accuracy.

9. File the form: You can file your completed form electronically through various online platforms, such as the IRS website or tax preparation software. Alternatively, you can print the form and mail it to the appropriate IRS address.

Remember, it's recommended to consult with a tax professional or utilize tax software to ensure accuracy and maximize your tax benefits. The instructions provided with each form can also be helpful in guiding you through the process.

What is the purpose of irs forms?

The purpose of IRS (Internal Revenue Service) forms is to provide a standardized way for taxpayers to report their financial information and fulfill their tax obligations. These forms serve various purposes such as:

1. Reporting Income: Forms such as W-2, 1099, and Schedule C are used to report various types of income including wages, dividends, interest, and self-employment income.

2. Claiming Deductions and Credits: Forms such as Schedule A and Form 8862 help taxpayers claim deductions and credits, reducing their taxable income and potentially lowering their tax liability.

3. Calculating Taxes Owed: Forms such as 1040, 1040A, and 1040EZ are used to calculate the amount of federal income tax owed based on the reported income, deductions, and exemptions.

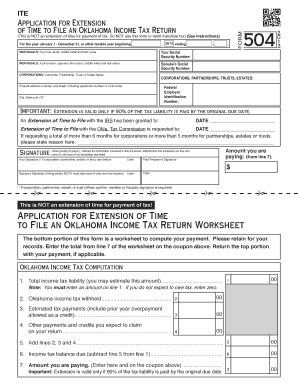

4. Requesting Extensions or Installment Agreements: Forms such as Form 4868 and Form 9465 allow taxpayers to request an extension of time to file their returns or to set up installment agreements for paying taxes owed over time.

5. Reporting Foreign Financial Accounts: Forms like FBAR (FinCEN Form 114) and Form 8938 are used to report foreign financial accounts and assets, ensuring compliance with the Foreign Account Tax Compliance Act (FATCA).

The purpose of these forms is to ensure accurate reporting of income, promote fairness in the tax system, and facilitate tax collection by the IRS.

When is the deadline to file irs forms in 2023?

The deadline to file IRS forms in 2023 will be April 17th, 2023. However, please note that this answer is based on the regular tax filing deadline for individuals. Certain circumstances or extensions could change the filing deadline, so it's always recommended to consult with the IRS or a tax professional for the most accurate and up-to-date information.

What is the penalty for the late filing of irs forms?

The penalty for late filing of IRS forms depends on the specific form that is being filed and whether you owe taxes or not. Here are some general penalties for late filing:

1. Late Filing Penalty: If you fail to file your tax return by the due date (usually April 15th), the penalty is typically 5% of the unpaid taxes for each month or part of the month that the return is late. The penalty can accumulate up to a maximum of 25% of the unpaid taxes.

2. Late Payment Penalty: If you owe taxes and fail to pay by the due date, the penalty is typically 0.5% of the unpaid taxes for each month or part of the month that the payment is late. This penalty can also accumulate up to a maximum of 25% of the unpaid taxes.

3. Failure to Pay Penalty: Besides the late payment penalty, you may also be charged a separate failure to pay penalty, which is typically 0.5% of the unpaid taxes for each month the taxes go unpaid. This penalty generally has a maximum of 25% as well.

It's important to note that the penalty rates may vary depending on the specific circumstances of your tax situation. Additionally, certain forms like the FBAR (FinCEN Form 114) have higher penalty amounts for late filing.

If you have a legitimate reason for your late filing, you may be able to request a penalty abatement or extension by contacting the IRS.

How do I execute information irs online?

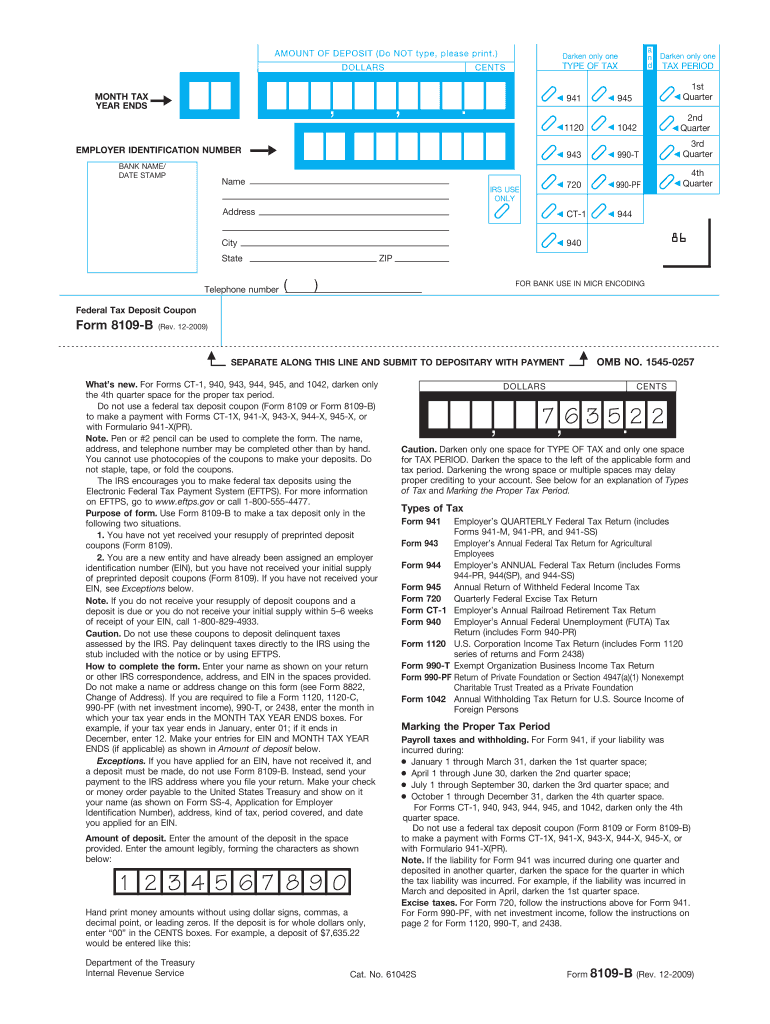

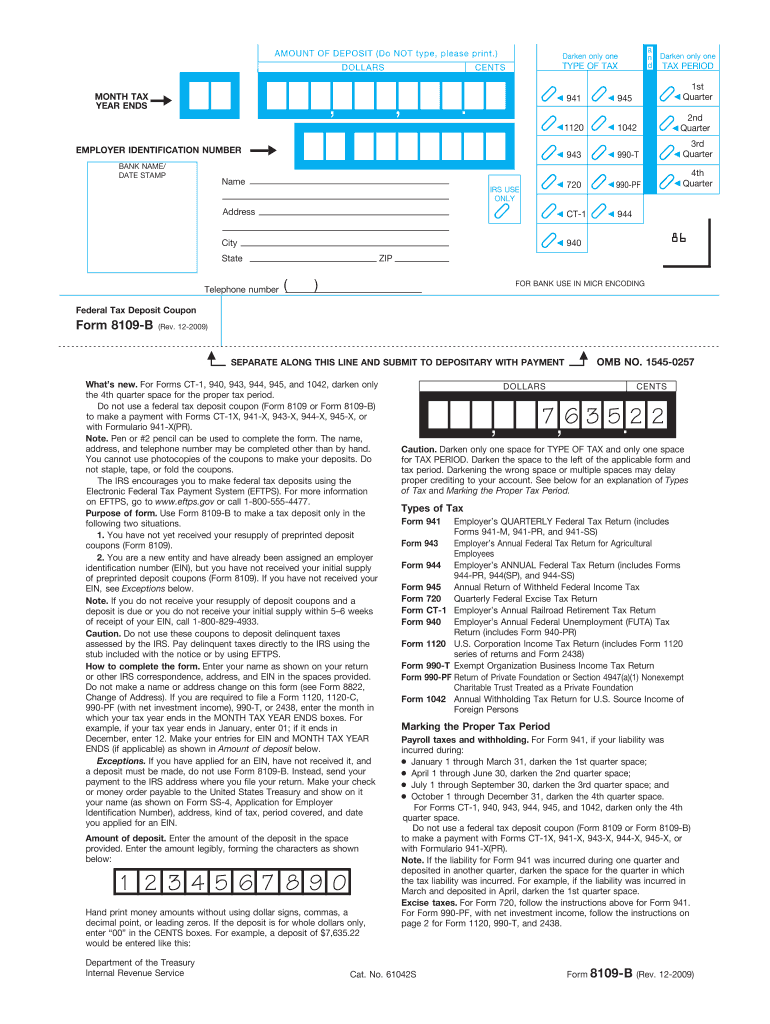

pdfFiller has made filling out and eSigning tax deposit coupon form easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How can I fill out how to 8109 federal deposit coupon on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your 8109 b. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I edit 8109b on an Android device?

With the pdfFiller Android app, you can edit, sign, and share form 1040 v payment voucher on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!